All the turmoil in the markets over the war in Ukraine, inflation, the Fed’s rate hikes are drowning out what could be the biggest catalyst for the sharp slowdown in global growth: China.

Things are suddenly going wrong in China as a confluence of events threatens to undermine anything close to Beijing’s goal of 5.5% GDP growth this year.

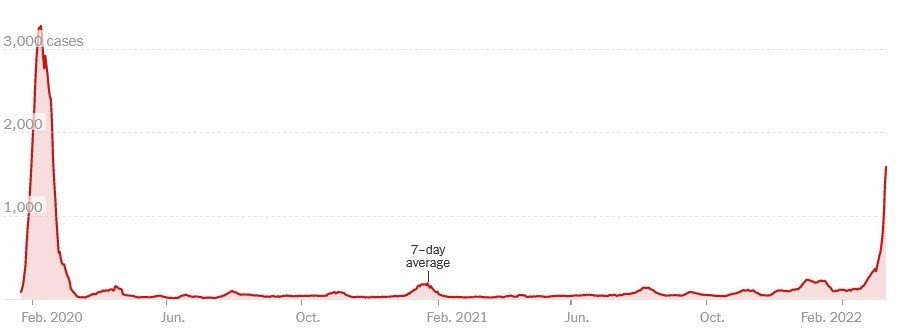

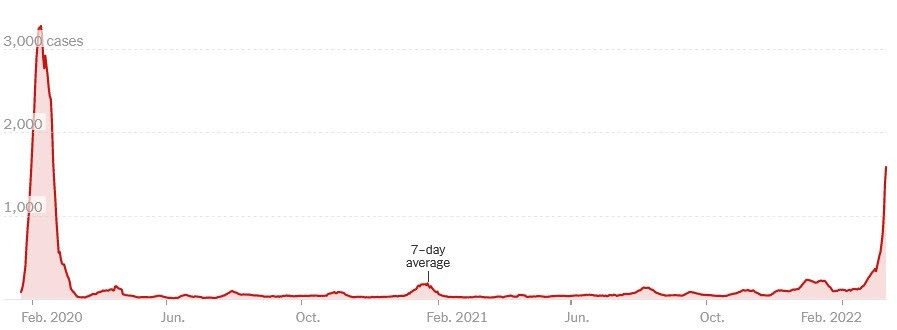

1) Covid outbreak

Covid cases in China are at a two-year high. The nightmare scenario is that something like Hong Kong is unfolding, where a handful of cases have grown exponentially to +30,000 per day and are spreading completely out of control.

Jilin Province (pop. 24 million) closed along with Shanghai and Shenzhen. I was surprised by China’s ability to suppress various waves of covid, but omicron is the most difficult test, with 27 out of 31 provinces reporting 2,125 local cases.

2) Commodity inflation

There is a temptation to view emerging markets as a monolith, but the first difference, in my opinion, is that between emerging markets that export goods (Latin America, Africa, the Middle East) and their importers (India, China, Turkey). This divergence will explode next year as money flows from the first category to the second. China is socially vulnerable to high commodity prices.

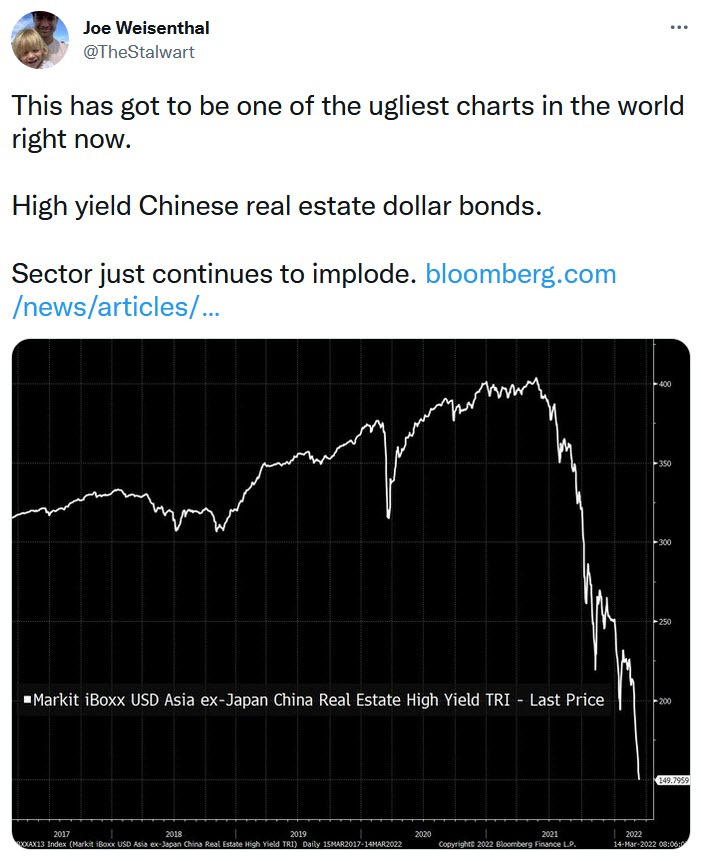

3) Real estate market

The Evergrande explosion last year had everyone watching China for signs of contagion, and when it didn’t happen quickly, the market lost focus. The pain intensifies. In January, land sales by local governments were down 72% year on year. The losses are reflected across the sector, with bond yields now over 25% and prices falling for 14 straight days.

4) Chinese technology explosion

KWEB is an American ETF that tracks stocks of Chinese technology companies.

A global tech downturn, but Chinese tech stocks have been hit doubly by the advent of the Great Firewall. US technology is cut off from China and vice versa. This peaked just as Jack Ma disappeared, and has since signaled that Chinese tech firms will work for the state, not shareholders.

5) Central bank plug

High commodity prices and global inflation tie the hands of the NBK. With headwinds in China due to the coronavirus and a collapse in the real estate market, the normal momentum would be to ease policy, but rising inflation could stifle that response. Of course, there are levers that China can pull, but it’s not as straightforward as it seemed a year ago.

ADVERTISING – CONTINUE TO READ BELOW